N.B. I am not a financial advisor

Most financial advisors are little more than leeches, telling you whatever they think you want to hear so they can earn their commissions. Learn to invest for yourself. You can do it. Hopefully this blog will contribute to that a little bit.

Thursday, December 30, 2010

U.S. Companies Saving Billions Using Tax Schemes With Names Like 'The Deadly D'

| U.S. Companies Saving Billions Using Tax Schemes With Names Like 'The Deadly D' | |

What nobody's saying publicly is that U.S. multinationals are already finding legal ways to avoid that tax. Over the years, they've brought cash home, tax-free,... | ||

Labels:

income tax,

multinational

As First Boomers Retire, Many Facing Personal Finance Disasters

| As First Boomers Retire, Many Facing Personal Finance Disasters | |

| Through a combination of procrastination and bad timing, many baby boomers are facing a personal finance disaster just as they're hoping to retire.... | ||

Labels:

boomers,

investing,

personal finance,

savings

Monday, December 13, 2010

A Secretive Banking Elite Rules Trading in Derivatives

On the third Wednesday of every month, the nine members of an elite Wall Street society gather in Midtown Manhattan.

The men share a common goal: to protect the interests of big banks in the vast market for derivatives, one of the most profitable — and controversial — fields in finance. They also share a common secret: The details of their meetings, even their identities, have been strictly confidential.

In theory, this group exists to safeguard the integrity of the multitrillion-dollar market. In practice, it also defends the dominance of the big banks.

Read more: http://www.nytimes.com/2010/12/12/business/12advantage.html?pagewanted=1&_r=2

The men share a common goal: to protect the interests of big banks in the vast market for derivatives, one of the most profitable — and controversial — fields in finance. They also share a common secret: The details of their meetings, even their identities, have been strictly confidential.

In theory, this group exists to safeguard the integrity of the multitrillion-dollar market. In practice, it also defends the dominance of the big banks.

Read more: http://www.nytimes.com/2010/12/12/business/12advantage.html?pagewanted=1&_r=2

Thursday, November 25, 2010

Understanding The Sharpe Ratio

Since the Sharpe ratio was derived in 1966 by William Sharpe, it has been one of the most referenced risk/return measures used in finance, and much of this popularity can be attributed to its simplicity. The ratio's credibility was boosted further when Professor Sharpe won a Nobel Memorial Prize in Economic Sciences in 1990 for his work on the capital asset pricing model (CAPM). In this article, we'll show you how this historic thinker can help bring you profits. (To find out more on this subject, see The Capital Asset Pricing Model: An Overview and The Sharpe Ratio Can Oversimplify Risk.)

Wednesday, November 3, 2010

9 Places Where You Can Retire and Live Like a King

Whatever your age, retirement should be an opportunity to do all the things that you always wanted to do, but were too busy to try. Perhaps you’ll pursue a neglected hobby or even launch another business but this time from a more exotic locale. From changes in scenery to endless recreation, business tax breaks to huge exchange rate benefits, a number of international locations are well-worth consideration as retirement destinations. For those not yet looking to retire, they make good vacation getaways as well:

Whatever your age, retirement should be an opportunity to do all the things that you always wanted to do, but were too busy to try. Perhaps you’ll pursue a neglected hobby or even launch another business but this time from a more exotic locale. From changes in scenery to endless recreation, business tax breaks to huge exchange rate benefits, a number of international locations are well-worth consideration as retirement destinations. For those not yet looking to retire, they make good vacation getaways as well:http://www.mint.com/blog/goals/9-places-where-you-can-retire-and-live-like-a-king/

Labels:

retirement,

vacation

Saturday, October 30, 2010

7 Money Tricks Rich Guys Know

My dad taught me how to rig a mainsail, my college buddies taught me how to hold my Jim Beam, and my teachers taught me how to parse Chaucer. But somehow no one got around to helping me calculate compound interest or build a diversified portfolio. Arcane skills? Perhaps, but learning them is the best way to avoid spending your retirement years nibbling on Alpo.

Of course, people teach only what they know, and previous generations had less cause to study the finer points of finance, says Charles Farrell, a Denver-based investment advisor. Most men died within a few years of retirement; the rest squeaked by on pensions and Social Security. Today, employer pension plans are largely history and Social Security is endangered, leaving us to rely on our own savings during our waning years. And with life expectancies rising, we'd better be prepared to grow those savings and make them last. "This generation has to figure out how to afford to live off its investments for 20 to 30 years," Farrell says. "It's never been tried before."

Ensuring your financial survival will require learning to be your own CFO. Herewith, seven skills to help begin your education.

Read more: http://www.menshealth.com/fitinvestor/moneytricks.html

Of course, people teach only what they know, and previous generations had less cause to study the finer points of finance, says Charles Farrell, a Denver-based investment advisor. Most men died within a few years of retirement; the rest squeaked by on pensions and Social Security. Today, employer pension plans are largely history and Social Security is endangered, leaving us to rely on our own savings during our waning years. And with life expectancies rising, we'd better be prepared to grow those savings and make them last. "This generation has to figure out how to afford to live off its investments for 20 to 30 years," Farrell says. "It's never been tried before."

Read more: http://www.menshealth.com/fitinvestor/moneytricks.html

Wednesday, October 27, 2010

Secrecy deal with Switzerland could let Britons avoid £40bn in taxes

Wealthy Britons could dodge £40bn in tax payments after the UK agreed ahead of negotiations on a tax deal with Switzerland that the country could maintain its traditional banking secrecy.

Thousands of higher rate taxpayers, who pay 50% tax on their income in the UK, will be allowed to keep their secret accounts in Zurich and Geneva and pay a low tax rate after the Treasury failed to secure agreement on sharing bank details.

Read the whole story: http://www.guardian.co.uk/business/2010/oct/26/tax-avoidance-switzerland-agreement

Thousands of higher rate taxpayers, who pay 50% tax on their income in the UK, will be allowed to keep their secret accounts in Zurich and Geneva and pay a low tax rate after the Treasury failed to secure agreement on sharing bank details.

Read the whole story: http://www.guardian.co.uk/business/2010/oct/26/tax-avoidance-switzerland-agreement

Tuesday, October 26, 2010

How ETFs Can Help You Avoid Investing Mistakes

For decades, financial theories were based on the assumption that all market participants were rational decision makers, acting in their own self-interest. This simplifying assumption led to great insights like Harry Markowitz’s Modern Portfolio Theory and practical applications like index funds with their low costs and difficult-to-beat returns. However, recent academic work has focussed on a more realistic view of the market where investors often act irrationally, as many economists felt that the previous economic framework insufficiently described what they observed in reality. It doesn’t take a PhD to realise that humans make mistakes.

Read more: http://www.morningstar.co.uk/uk/news/article.aspx?lang=en-GB&articleid=90508&categoryid=656

Read more: http://www.morningstar.co.uk/uk/news/article.aspx?lang=en-GB&articleid=90508&categoryid=656

Sunday, October 24, 2010

30 Free eBooks To Learn Everything You Want to Know About Personal Finance

When you reach into a broad-ranging topic like personal finance, you find everyone and their cousin trying to reach across the Internet to give you advice. There’s so much information there that it can literally be overwhelming; there’s literally too much for the average person to sort through.

Luckily for you, at Mint we’re looking to quash that “intimidation” factor. There’s no reason that personal finance can’t be thoughtful, cohesive, and comprehensive, so we’ve probed through the web to find 30 free e-Books/booklets across the topics you’ll reference most.

We’ve sorted these e-Books into specific categories, along with a brief description we’ve written up on each of them. Everything is in PDF format, so if an e-Book strikes your fancy, consider downloading a copy by right-clicking on the link, then clicking “Save As.”

http://blog.mint.com/blog/finance-core/30-free-ebooks-to-learn-everything-you-want-to-know-about-personal-finance/

Luckily for you, at Mint we’re looking to quash that “intimidation” factor. There’s no reason that personal finance can’t be thoughtful, cohesive, and comprehensive, so we’ve probed through the web to find 30 free e-Books/booklets across the topics you’ll reference most.

We’ve sorted these e-Books into specific categories, along with a brief description we’ve written up on each of them. Everything is in PDF format, so if an e-Book strikes your fancy, consider downloading a copy by right-clicking on the link, then clicking “Save As.”

http://blog.mint.com/blog/finance-core/30-free-ebooks-to-learn-everything-you-want-to-know-about-personal-finance/

Saturday, October 23, 2010

Visual Guide to Deflation

Deflation is inflation’s polar opposite. It’s what happens when prices go down and you get more bang for your buck. Sounds good right? But deflation, like inflation is complicated and much less understood than inflation. It can lead to what’s called the deflationary spiral and grind the whole economy to a halt.

Read the whole piece here: http://www.mint.com/blog/finance-core/a-visual-guide-to-deflation/

Read the whole piece here: http://www.mint.com/blog/finance-core/a-visual-guide-to-deflation/

Wednesday, October 20, 2010

Tax Highlights for U.S. Citizens and Residents Living Abroad

This article discusses in general terms some provisions of the U.S. federal income tax law that apply to U.S. citizens and resident aliens who live or work abroad and who expect to receive income from foreign sources.

As a U.S. citizen or resident alien, your worldwide income generally is subject to U.S. income tax regardless of where you are living. Also, you are subject to the same income tax return filing requirements that apply to U.S. citizens or residents living in the United States.

However, several income tax benefits might apply if you meet certain requirements while living abroad. You may be able to exclude from your income a limited amount of your foreign earned income.

Read the full article: http://www.taxmeless.com/IRS593Publication.htm

As a U.S. citizen or resident alien, your worldwide income generally is subject to U.S. income tax regardless of where you are living. Also, you are subject to the same income tax return filing requirements that apply to U.S. citizens or residents living in the United States.

However, several income tax benefits might apply if you meet certain requirements while living abroad. You may be able to exclude from your income a limited amount of your foreign earned income.

Read the full article: http://www.taxmeless.com/IRS593Publication.htm

Labels:

income tax,

IRS,

tax,

U.S.

Tuesday, October 19, 2010

Lots of Good Articles Here

Thanks to the people at Portfolio Solutions for putting up a long list of quality material.

http://www.portfoliosolutions.com/research.html

http://www.portfoliosolutions.com/research.html

Friday, October 1, 2010

How to Create a "Do it Yourself" Investment Management Portfolio

DIY portfolio management reduces investing expense. When an investor moves from a full price broker to an online broker it reduces commission cost. Making your own buy/sell decisions eliminates the need for a manager and gets rid of the management fees, annual fees, quarterly fees, inactivity fees, planning fees and……. Well you get the picture. But it could also be a trap of your own making.

Index Investing - DIY Vs Hiring an Investment Advisor

By George Watkins

On the surface, index investing seems like a perfect fit for do-it-yourself investors. The simplistic buy-hold-rebalance mantra of index fund proponents combined with the abundance of help from investing authors and online forums leads scores of informed investors to take on the task of personal portfolio management each year.

Many DIY investors never look back; they treasure their newfound fiscal autonomy and the challenge of overcoming future financial hurdles. Others, however, discover that they lack the time, interest, knowledge or discipline to successfully negotiate the dangerous DIY terrain, and they ultimately seek help from an investment advisor.

The purpose of this article is to clearly present the rationale for each approach so that index investors can decide which tactic best suits their needs and abilities.

On the surface, index investing seems like a perfect fit for do-it-yourself investors. The simplistic buy-hold-rebalance mantra of index fund proponents combined with the abundance of help from investing authors and online forums leads scores of informed investors to take on the task of personal portfolio management each year.

Many DIY investors never look back; they treasure their newfound fiscal autonomy and the challenge of overcoming future financial hurdles. Others, however, discover that they lack the time, interest, knowledge or discipline to successfully negotiate the dangerous DIY terrain, and they ultimately seek help from an investment advisor.

The purpose of this article is to clearly present the rationale for each approach so that index investors can decide which tactic best suits their needs and abilities.

Is Do-It-Yourself Investing Right for You?

By Mary Rowland

One of the first questions investors ask is this: Should I invest on my own or get the help of a financial planner?

For many investors, the answer is an obvious one. If you receive a large inheritance or divorce or insurance settlement and have no knowledge of the markets, you need help. But what about the rest of us? We know a little bit. We're willing to learn more. We're intrigued by the idea of investing. But will we do a good job?

One of the first questions investors ask is this: Should I invest on my own or get the help of a financial planner?

For many investors, the answer is an obvious one. If you receive a large inheritance or divorce or insurance settlement and have no knowledge of the markets, you need help. But what about the rest of us? We know a little bit. We're willing to learn more. We're intrigued by the idea of investing. But will we do a good job?

Labels:

DIY,

ETFs,

investing,

mutual funds

Saturday, September 18, 2010

Book Review: Getting Started in Finding a Financial Advisor

By Chuck Jaffe

John Wiley & Sons

2010

All of the books in my Recommended Reading list (in the right hand menu) are books I recommend. Unfortunately, this one doesn't make the cut.

On the plus side, Jaffe lists several important questions everyone should ask an adviser they are considering working with. What are your qualifications? Who is your typical client? How do you charge for your services? Can I have some references? What makes me the kind of client you'd like to work with? How often will I hear from you?

However, the bulk of the book is a rehash of these same points in chapters on finding a broker, an insurance agent, a real estate agent, an accountant, a lawyer... you get the picture. 7 of the 15 chapters are almost identical.

The book does a good job of encouraging people to take time and care in selecting an adviser, but there are plenty of web sites offering the same information for free. A simple google search on "finding financial adviser" yields plenty of useful results.

My financial advice here? Save your $20.

John Wiley & Sons

2010

All of the books in my Recommended Reading list (in the right hand menu) are books I recommend. Unfortunately, this one doesn't make the cut.

On the plus side, Jaffe lists several important questions everyone should ask an adviser they are considering working with. What are your qualifications? Who is your typical client? How do you charge for your services? Can I have some references? What makes me the kind of client you'd like to work with? How often will I hear from you?

However, the bulk of the book is a rehash of these same points in chapters on finding a broker, an insurance agent, a real estate agent, an accountant, a lawyer... you get the picture. 7 of the 15 chapters are almost identical.

The book does a good job of encouraging people to take time and care in selecting an adviser, but there are plenty of web sites offering the same information for free. A simple google search on "finding financial adviser" yields plenty of useful results.

My financial advice here? Save your $20.

Labels:

books,

financial advice

Tuesday, September 7, 2010

The Total Cost of ETF Ownership

Expense ratios are just one of the many costs of ETF ownership

The low cost of exchange-traded funds relative to traditional actively managed open end funds and index trackers is perhaps their most appealing feature. When looking at the cost savings of ETFs, and comparing one fund to another, most of us just look at the total expense ratio given in prospectuses and other literature. But expense ratios reflect just one of the many costs of ETF ownership. Costs of buying, selling, and potential hidden charges or earnings all affect the ultimate returns that shareholders get from a given ETF.Expatriates under-utilise offshore centres for savings and investing, survey finds

Expatriates under-utilise offshore centres for savings and investing, and their most popular investment vehicles are managed funds (16%) and foreign exchange (12%), according to HSBC Bank International's latest Expat Explorer survey.

Saturday, September 4, 2010

4 Steps To Building A Profitable Portfolio

In today's financial marketplace, a well-maintained portfolio is vital to any investor's success. As an individual investor, you need to know how to determine an asset allocation that best conforms to your personal investment goals and strategies. In other words, your portfolio should meet your future needs for capital and give you peace of mind. Investors can construct portfolios aligned to their goals and investment strategies by following a systematic approach. Here we go over some essential steps for taking such an approach.

Read the whole article on Investopedia here:

http://www.investopedia.com/articles/pf/05/060805.asp

Wednesday, September 1, 2010

I had to laugh...

Wow. Turn $200 into $10 million in one year! And you'll tell me for free? All you want is my e-mail address...

I laughed when I saw this in my in-box, but actually it's not very funny. There are a lot of people who try to prey on people who just don't know any better or who are in a difficult position and are ready to grasp at straws.

Help educate your family and friends about investing scams. Help them find out about realistic ways to improve their financial situation. And let's put the scammers out of business.

Thursday, August 26, 2010

Investopedia: Investing Tutorials - Basics

If you want to learn more about the confusing world of finance you've come to the right spot! We'd love to be your guide on the journey to financial freedom, and it all starts here. The following is our compilation of tutorials on subjects we feel every investor should know and understand. What you learn here will set the foundation for everything in the future.

Read more here:

http://www.investopedia.com/university/buildingblocks.asp

Read more here:

http://www.investopedia.com/university/buildingblocks.asp

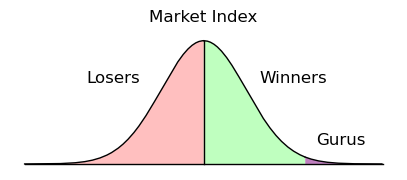

Is "Buy and Hold" really the way to go?

...But if there are no legitimate public winning strategies, if instead it's a fair market and everyone has the same opportunity for success, how can some people become multimillionaires while others lose their money? That can't be because of chance, can it?

Well, as a matter of fact, yes, investment success can and does result from pure chance, and stories of investment success are much more likely to result from chance than genius.

Because everyone is trying to outwit everyone else in unpredictable ways, the stock market is much more a random process than a moral drama with predictable winners and losers. But even though the market doesn't (and cannot) reward investment ingenuity, it does pay attention to chance factors.

Read the full article here:

http://arachnoid.com/randomness/index.html#Investment_Genius

Labels:

chance,

investing,

stock market,

strategy

Monday, August 23, 2010

In Striking Shift, Small Investors Flee Stock Market

"According to the Investment Company Institute, which surveys 4,000 households annually, the appetite for stock market risk among American investors of all ages has been declining steadily since it peaked around 2001, and the change is most pronounced in the under-35 age group."

Wow. That's bad... If you can help it, DO NOT pull your money out (unless you are close to retirement). If you are young, you are missing a great opportunity. You know how they say "buy low, sell high"? Well, when do you think that "low" time is?

Read the full story:

http://www.nytimes.com/2010/08/22/business/22invest.html?_r=1&ref=business

Wow. That's bad... If you can help it, DO NOT pull your money out (unless you are close to retirement). If you are young, you are missing a great opportunity. You know how they say "buy low, sell high"? Well, when do you think that "low" time is?

Read the full story:

http://www.nytimes.com/2010/08/22/business/22invest.html?_r=1&ref=business

Labels:

investing,

mutual funds,

risk,

stock market

Sunday, August 22, 2010

Read This, Retire Rich

It took our in-house financial guru decades to learn these wealth-building rules. It'll take you about 10 minutes

By: Ben Stein

Many years ago, when I first started filming Win Ben Stein's Money, my makeup artist was named Suzie. As Suzie combed, straightened, and powdered, I was often reading the Wall Street Journal or Barron's or talking on the phone with my pal Phil DeMuth about investments. At least once a week, Suzie would set her jaw firmly and say, "I've got to learn all about this investing thing."

Read the full article here: www.menshealth.com/menswealth/mw_stein.html

By: Ben Stein

Many years ago, when I first started filming Win Ben Stein's Money, my makeup artist was named Suzie. As Suzie combed, straightened, and powdered, I was often reading the Wall Street Journal or Barron's or talking on the phone with my pal Phil DeMuth about investments. At least once a week, Suzie would set her jaw firmly and say, "I've got to learn all about this investing thing."

Read the full article here: www.menshealth.com/menswealth/mw_stein.html

Labels:

401(k),

diversification,

index fund,

investing,

stock market

Friday, August 20, 2010

Take Advantage of Dollar-Yen Exchange Rate

The dollar-yen exchange rate is down to 85 (85 yen buy 1 dollar), a 15-year low. Just two years ago (July 2007), it was at 120. What does that mean for people investing in US dollar-denominated funds?

At a rate of 120, 100,000 yen buys you $833.33 worth of USD funds.

At a rate of 85, 100,000 buys you $1176.47 worth of USD funds - an increase of 41%!

If you a long-term investor, now might be a good time to put a little bit of extra money into your USD funds.

Labels:

currency,

dollar,

exchange rate,

investing,

yen

Wednesday, August 11, 2010

Claim That Tax Cuts "Pay For Themselves" Is Too Good To Be True

Revised July 26, 2006

In recent statements, the President, the Vice President, and key Congressional leaders have asserted that the increase in revenues in 2005 and the increase now projected for 2006 prove that tax cuts “pay for themselves.” In other words, the economy expands so much as a result of tax cuts that it produces the same level of revenue as it would have without the tax cuts.

In fact, however, the evidence tells a very different story: the tax cuts have not paid for themselves, and economic growth and revenue growth over the course of the recovery have not been particularly strong.

Read the full article here

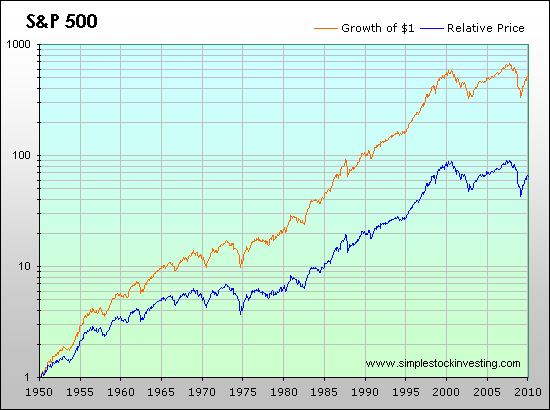

S&P 500: Total and Inflation-Adjusted Historical Returns

Historical prices for the Standard & Poor's 500 stock-market index can be obtained from websites like Yahoo Finance, using the ^GSPC ticker, or Google Finance, with .INX. Yahoo can even graph the series since 1950. Those numbers, and their corresponding graphs, are useful for evaluating the past performance of stock investments, because the S&P500 index is well regarded as a proxy for the large-cap stock market. Nevertheless, to study the real profitability of the market, we need to average and graph not only the price, but the effect of dividend distributions and inflation as well. That is the purpose of this work.

See the full article

Tuesday, August 10, 2010

The Political Genius Of Supply-Side Economics

The political genius of this idea is evident. Supply-side economics transformed Republicans from a minority party into a majority party. It allowed them to promise lower taxes, lower deficits and, in effect, unchanged spending. Why should people not like this combination? Who does not like a free lunch?

Read the full article

Subscribe to:

Comments (Atom)