If you want to learn more about the confusing world of finance you've come to the right spot! We'd love to be your guide on the journey to financial freedom, and it all starts here. The following is our compilation of tutorials on subjects we feel every investor should know and understand. What you learn here will set the foundation for everything in the future.

Read more here:

http://www.investopedia.com/university/buildingblocks.asp

N.B. I am not a financial advisor

Most financial advisors are little more than leeches, telling you whatever they think you want to hear so they can earn their commissions. Learn to invest for yourself. You can do it. Hopefully this blog will contribute to that a little bit.

Thursday, August 26, 2010

Is "Buy and Hold" really the way to go?

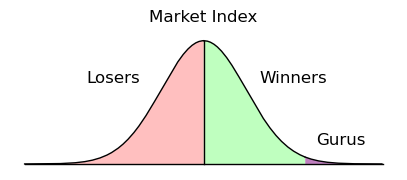

...But if there are no legitimate public winning strategies, if instead it's a fair market and everyone has the same opportunity for success, how can some people become multimillionaires while others lose their money? That can't be because of chance, can it?

Well, as a matter of fact, yes, investment success can and does result from pure chance, and stories of investment success are much more likely to result from chance than genius.

Because everyone is trying to outwit everyone else in unpredictable ways, the stock market is much more a random process than a moral drama with predictable winners and losers. But even though the market doesn't (and cannot) reward investment ingenuity, it does pay attention to chance factors.

Read the full article here:

http://arachnoid.com/randomness/index.html#Investment_Genius

Labels:

chance,

investing,

stock market,

strategy

Monday, August 23, 2010

In Striking Shift, Small Investors Flee Stock Market

"According to the Investment Company Institute, which surveys 4,000 households annually, the appetite for stock market risk among American investors of all ages has been declining steadily since it peaked around 2001, and the change is most pronounced in the under-35 age group."

Wow. That's bad... If you can help it, DO NOT pull your money out (unless you are close to retirement). If you are young, you are missing a great opportunity. You know how they say "buy low, sell high"? Well, when do you think that "low" time is?

Read the full story:

http://www.nytimes.com/2010/08/22/business/22invest.html?_r=1&ref=business

Wow. That's bad... If you can help it, DO NOT pull your money out (unless you are close to retirement). If you are young, you are missing a great opportunity. You know how they say "buy low, sell high"? Well, when do you think that "low" time is?

Read the full story:

http://www.nytimes.com/2010/08/22/business/22invest.html?_r=1&ref=business

Labels:

investing,

mutual funds,

risk,

stock market

Sunday, August 22, 2010

Read This, Retire Rich

It took our in-house financial guru decades to learn these wealth-building rules. It'll take you about 10 minutes

By: Ben Stein

Many years ago, when I first started filming Win Ben Stein's Money, my makeup artist was named Suzie. As Suzie combed, straightened, and powdered, I was often reading the Wall Street Journal or Barron's or talking on the phone with my pal Phil DeMuth about investments. At least once a week, Suzie would set her jaw firmly and say, "I've got to learn all about this investing thing."

Read the full article here: www.menshealth.com/menswealth/mw_stein.html

By: Ben Stein

Many years ago, when I first started filming Win Ben Stein's Money, my makeup artist was named Suzie. As Suzie combed, straightened, and powdered, I was often reading the Wall Street Journal or Barron's or talking on the phone with my pal Phil DeMuth about investments. At least once a week, Suzie would set her jaw firmly and say, "I've got to learn all about this investing thing."

Read the full article here: www.menshealth.com/menswealth/mw_stein.html

Labels:

401(k),

diversification,

index fund,

investing,

stock market

Friday, August 20, 2010

Take Advantage of Dollar-Yen Exchange Rate

The dollar-yen exchange rate is down to 85 (85 yen buy 1 dollar), a 15-year low. Just two years ago (July 2007), it was at 120. What does that mean for people investing in US dollar-denominated funds?

At a rate of 120, 100,000 yen buys you $833.33 worth of USD funds.

At a rate of 85, 100,000 buys you $1176.47 worth of USD funds - an increase of 41%!

If you a long-term investor, now might be a good time to put a little bit of extra money into your USD funds.

Labels:

currency,

dollar,

exchange rate,

investing,

yen

Wednesday, August 11, 2010

Claim That Tax Cuts "Pay For Themselves" Is Too Good To Be True

Revised July 26, 2006

In recent statements, the President, the Vice President, and key Congressional leaders have asserted that the increase in revenues in 2005 and the increase now projected for 2006 prove that tax cuts “pay for themselves.” In other words, the economy expands so much as a result of tax cuts that it produces the same level of revenue as it would have without the tax cuts.

In fact, however, the evidence tells a very different story: the tax cuts have not paid for themselves, and economic growth and revenue growth over the course of the recovery have not been particularly strong.

Read the full article here

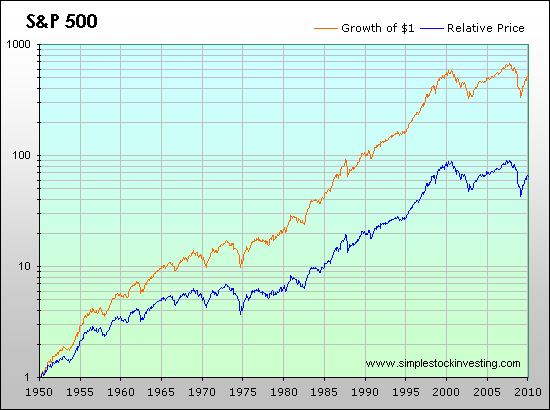

S&P 500: Total and Inflation-Adjusted Historical Returns

Historical prices for the Standard & Poor's 500 stock-market index can be obtained from websites like Yahoo Finance, using the ^GSPC ticker, or Google Finance, with .INX. Yahoo can even graph the series since 1950. Those numbers, and their corresponding graphs, are useful for evaluating the past performance of stock investments, because the S&P500 index is well regarded as a proxy for the large-cap stock market. Nevertheless, to study the real profitability of the market, we need to average and graph not only the price, but the effect of dividend distributions and inflation as well. That is the purpose of this work.

See the full article

Tuesday, August 10, 2010

The Political Genius Of Supply-Side Economics

The political genius of this idea is evident. Supply-side economics transformed Republicans from a minority party into a majority party. It allowed them to promise lower taxes, lower deficits and, in effect, unchanged spending. Why should people not like this combination? Who does not like a free lunch?

Read the full article

Subscribe to:

Comments (Atom)